07. Functionality for importing UK tax codes from DPS

7 people found this article helpful

Set up

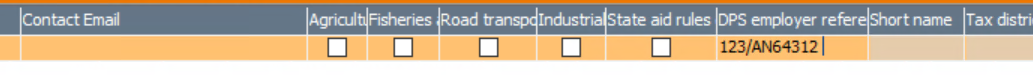

Open Settings | UK Setup HMRC reporting. For each company, enter the correct information in the box "DPS employer reference". Please notice the format xxx/yyyyyyy.

Press F12 to save.

Using the import functionality

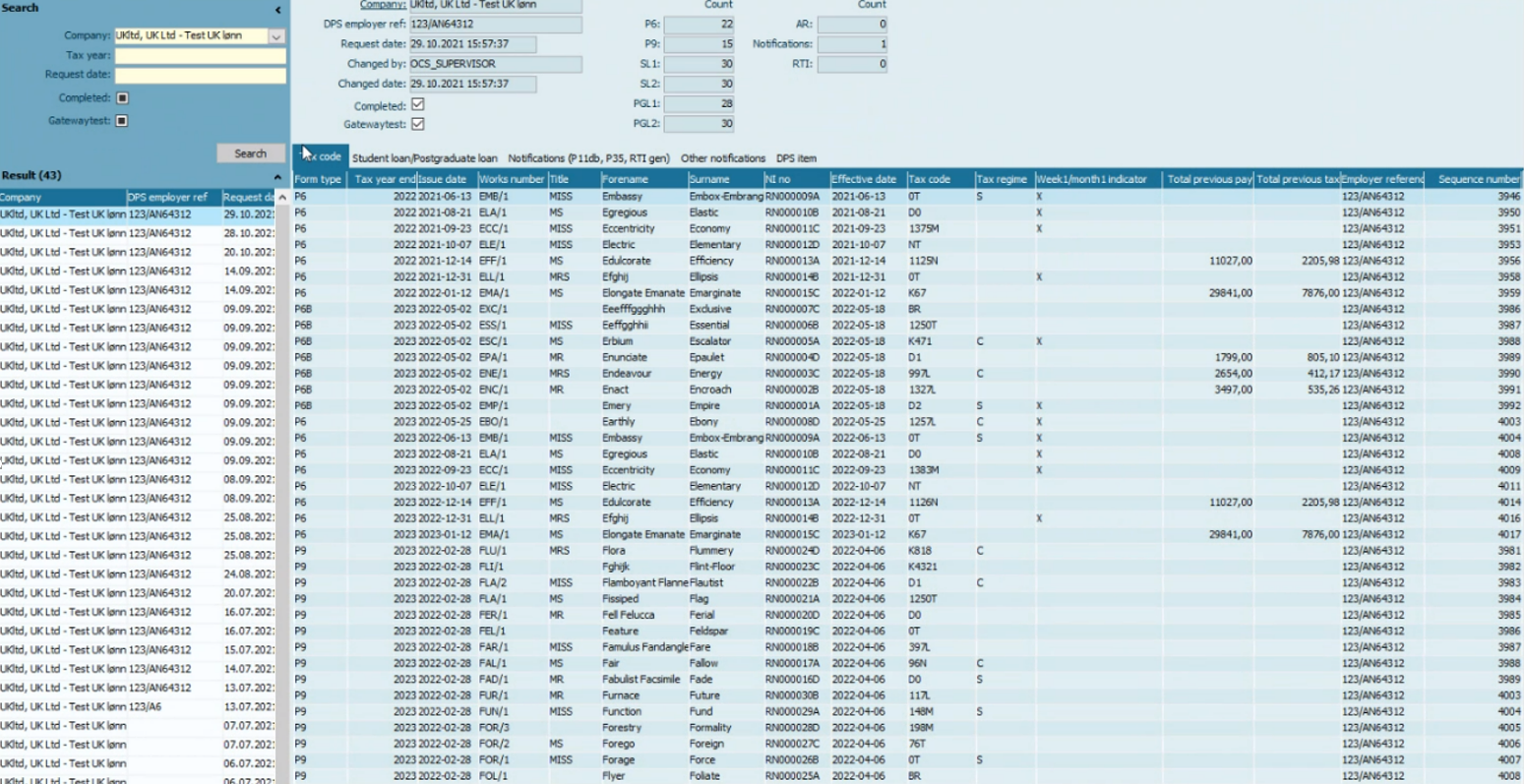

Open Autyorithy reporting | DPS for company.

The search functionality

In the search view to the left, you can enter;

"Tax year": We advise that the present tax year is entered, or the system will retrieve a huge amount of data.

"Request date": You can narrow down a specific import of data.

The box "Completed": The system returns imports that already has been used to update employee information. If it is not ticked off, only imports that has not been implemented will be shown.

Importing new information from DPS

Select the correct company in the left "Company" drop down. We also suggest the tax year is entered.

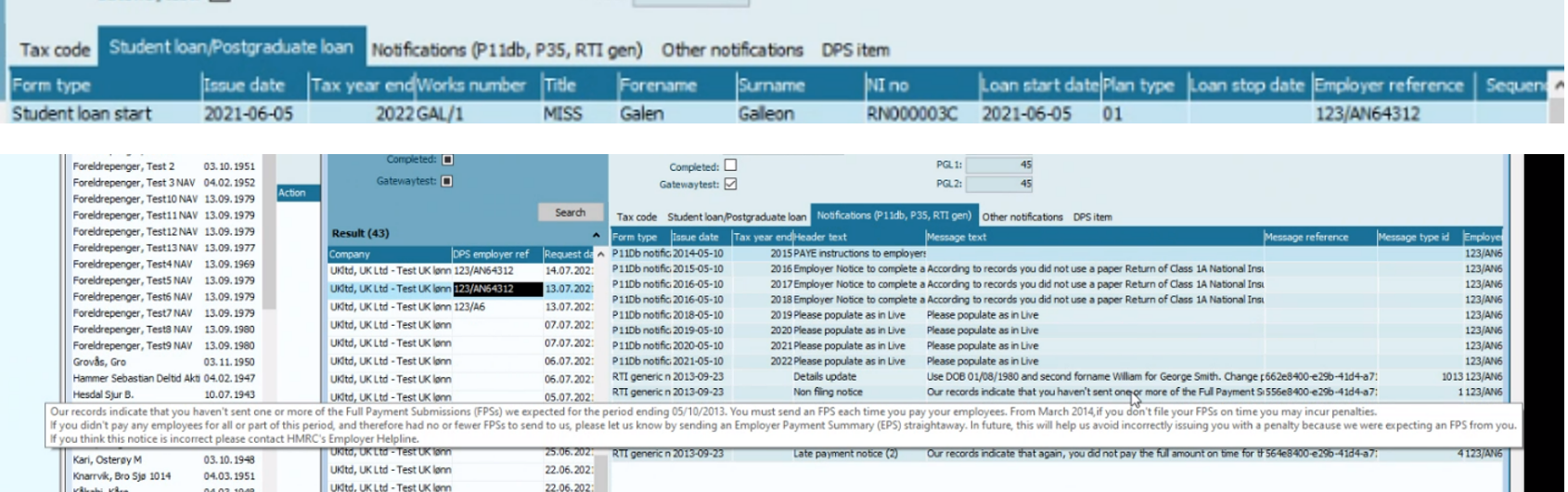

Open the "Actions menu". Press "Get DPS messages". The retrieved information will show. Select the tabs to view information about Tax codes, Student loans and notifications.

In the "Actions" menu, press "Update employee data" to automatically transfer information to the system, and to the individual employee.

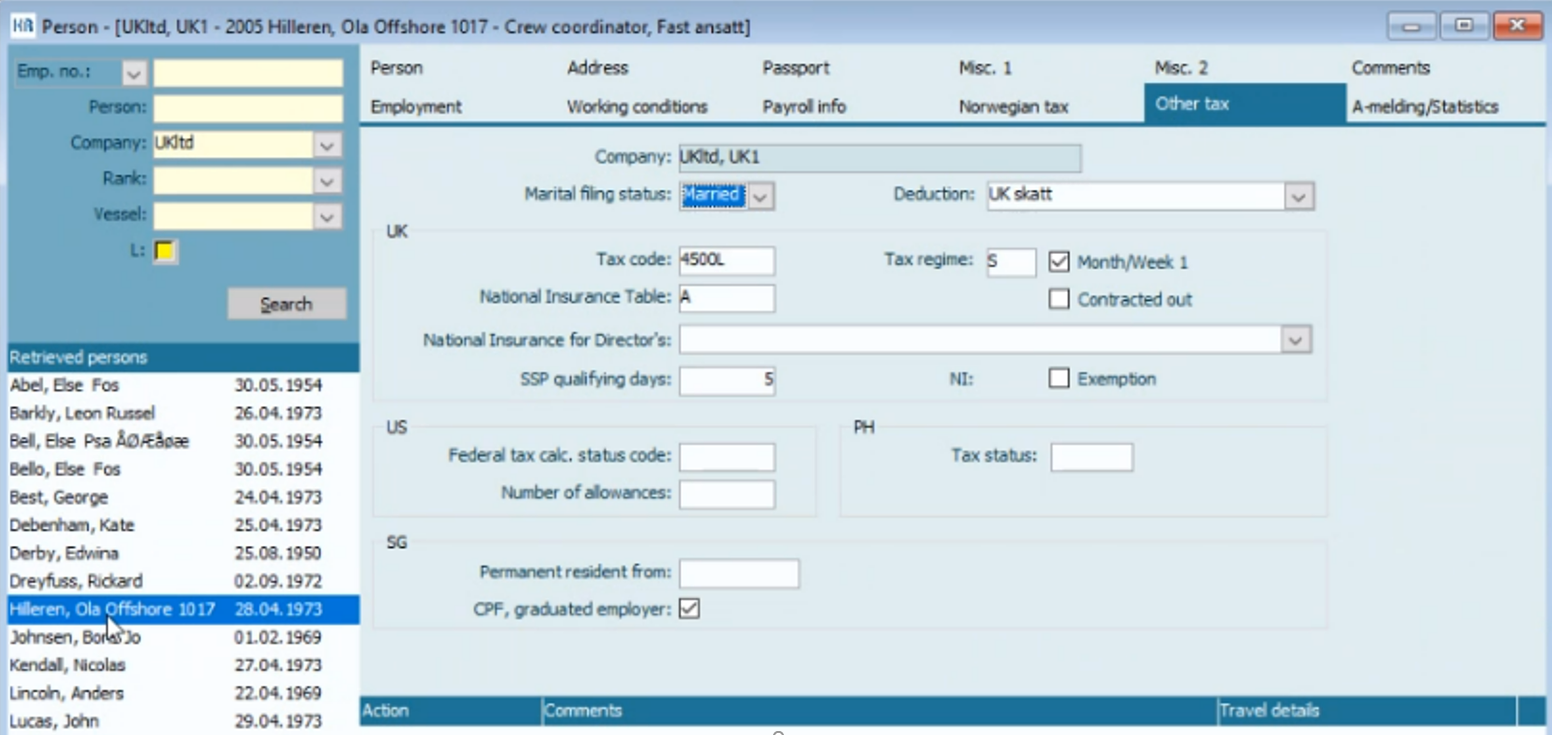

By opening the "Person view" of employees you can verify that the information has changed:

Notifications can be viewed by resting the marker on one individual notification in the "Notifications" tab.

Other menu items

In the "Actions" menu the many item "Show request response" will present the actual XML file that was received from DPS. The "Show response detail" can be used to narrow down to details in the same XML file.